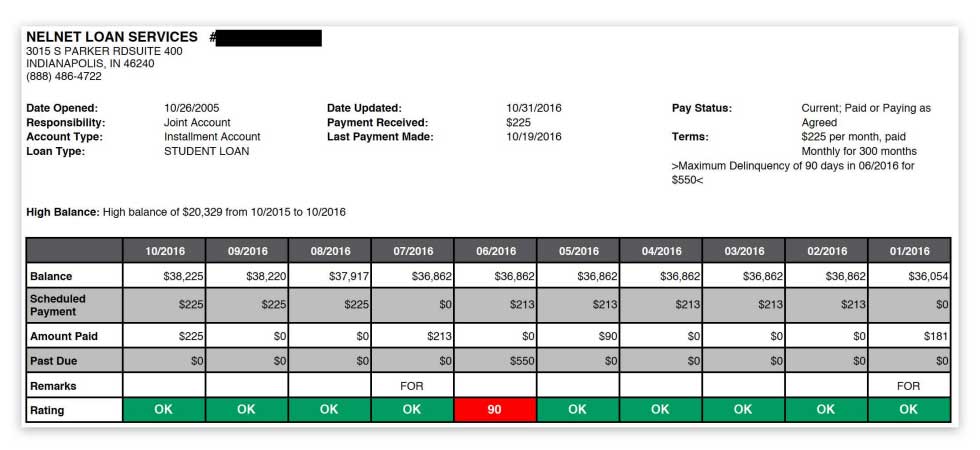

You also want to scan your report and search the payment history on all active and closed accounts. Account statuses showing as delinquent, past due, or current/previously late and showing 30/60/90/120+ day late payments are one of the most damaging items to your credit report and score, especially if they are recent. Late payments on closed and/or paid off accounts still impacts your score negatively.

Late payments on student loans can be particularly troublesome. Many readers have multiple student loans as a result of the process for obtaining them. Each semester, typically, you fill out your Financial Aid paperwork and loan forms. At the end of 2 years of college you would then have 4 accounts — one for each semester. Once you are finished with school and deferment/forbearance is over, you start repayment. Most people consolidate or make one payment. If you happen to miss a payment, you will show a 30-day late payment on 4 accounts (or 8 if you did 4 years of school). These must be challenged! Be sure to make note of any questionable late payments so we may challenge

them in the next chapter.

Even accurately reported late payments can be challenged using a technique called a “Goodwill Letter” which will be discussed later. Notice the late payment in the below image.