Store Card vs. Major Credit Card

Here, we’re going to discuss Store Card vs. Major Credit Card in this blog.

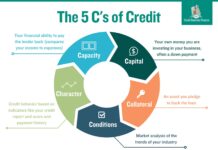

Is it better to be added to a store card or major credit card?

Do you know the Store Card vs. Major Credit Card difference?

It is better to get a major credit card if you will qualify.

Store cards are not ideal because they are not versatile forms of credit and they can only be used at a particular store because many of these cards are backed by places like Citibank and Capital One, or HSBC — meaning it is likely they will be reported to all three credit bureaus.

Pro Tip: It is harder to get a major credit card. Store cards tend to have a lower credit score requirements. You don’t want to just apply for every card you can, that will lower your score. Be strategic and ONLY apply for cards you know you have good chance of getting.

Click HERE to see a list of cards we recommend for credit building.

As Always… In case you haven’t yet, here’s how you get started.

Step 1:

Tap or click here to get your $1 credit report.

We’ll need it to do your credit analysis.

Note:

This is for a $1 seven-day trial.

You can cancel it in the first seven days if you want, but we need this as a first step, in order to help you.

Step 2:

You will get a login and password for IdentityIQ when you set up your $1 trial.

Go to this page on TheCreditMovement.com.

Share your username/password for IdentityIQ in the form on the page.

We are here to help you buy a home. We will introduce you to a lender once you will qualify for the loan you want.