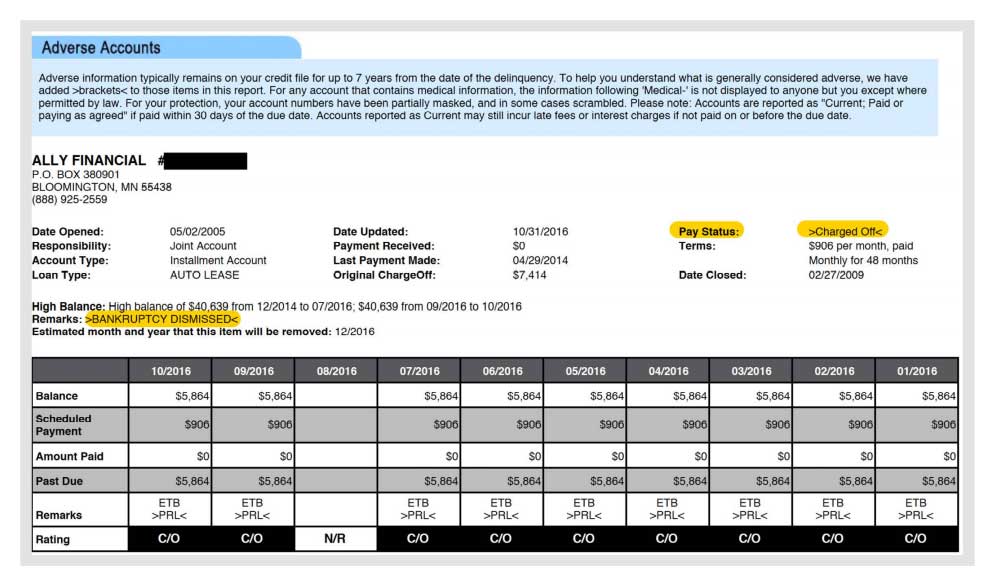

Following the personal information section (Credit Report ), you get into the tradelines that are being reported to the credit bureaus. These tradeline items ultimately factor into your score. When scanning the trade lines it is important to notice the account type, account status, and payment history. Notice account types such as Charge off, Included in Bankruptcy, Profit, Loss, and Collection. The below image gives you an idea of what to look for.

Notice the “Charged Off” status and “Bankruptcy” note in the remarks. Check for duplicate accounts. Here is an example: Capital One’s credit card went unpaid and was charged off, after writing off the account as a loss on their books (taxes), they then sold it to ABC Collections. Now the same account is on your report multiple times.

Look for glaring errors that give you a solid reason for disputing and requesting removal. Some errors are more obvious than others. You are the best judge of the accuracy of the information on your report. What items are legitimate and who do you authorize to pull your credit report? You know whether or not a certain account should show as included in a bankruptcy. You know about the insurance which covers medical bills. Be sure to write down all items you would like to dispute so we may challenge them in the next chapter.

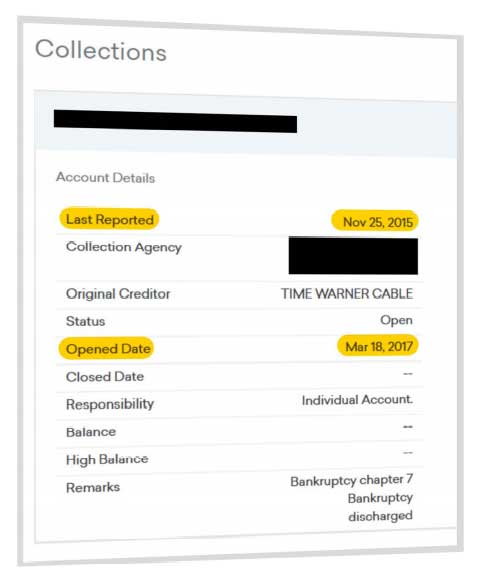

The image below shows an obvious error —

A collection account showing a “Last Reported Date” of November 25, 2015. The “Opened Date” is March 18, 2017.

For example, a $10,000 balance on an open collection could impact your score in the same way as a collection with a $0 balance. I know, it sounds crazy, but it’s true. If the original creditor data is available, be sure to document that so we may challenge it in the next chapter. Each of these steps is important. Because of HIPAA privacy laws, medical debts often leave off the name of the hospital or clinic where the medical debt originated — that is ok, just note the original creditor as “medical”. If you have a collection for ABC Collections, for instance, and it notes the original credit as XYZ Apartment Property Management — this would indicate an “eviction” and it’s important it is documented as such so you can work to correct it using the appropriate steps in the chapters. Later we’ll discuss how to deal with each of these accounts!