The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) clearly states that items on a consumer credit report must be reported with completeness, accuracy, and verifiability. According to a recent study, 79% of credit reports contain detrimental errors. Obsolete information must be properly disputed before removal at a credit bureau level. We will share sample dispute letters and include the specific language of the FCRA, mainly focused on Section 623.

When a negative item is disputed,

it is removed from your credit report during the investigation. If it is found to be valid, the creditor is required to notify you within 5 days that they added the negative item back to your account. If they didn’t do that, they violated the Fair Credit Reporting Act. You may now send them a letter (free download on this site) and have the time removed.

Have you hired a credit repair company?

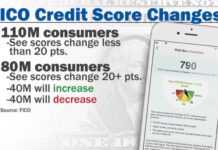

Pay attention! Many have told us that after hiring a credit repair company, they saw their score increase only to be shocked a month or two later when their score decreases again. Why is that? Let’s dig into that….

When trying to improve your credit score it is natural to want to find a quick solution to your issues. Many chose to hire a credit repair company based on false hope or promises of fast results. Others use the online dispute process. So what is the big issue? Disputing items directly with the credit bureaus will often lead to items being reinserted onto the credit report a month or so later. Why? The simple answer is….the credit bureaus don’t have control of the data on your report. The creditors do.

Data furnishers (aka Creditors) such as collection agencies, auto finance companies, credit card companies, mortgage banks, etc., are the ones who report data to the credit bureaus (Experian, Equifax, and TransUnion). When you dispute an item, it will get removed from the report. The issue? Next month when the creditor sends a batch of data to the credit bureaus, those deleted items will reappear.

So what can you do for The Fair Reporting Act?

Get familiar with the Fair Credit Reporting Act (FCRA) and Fair Debt Collection Practices Act (FDCPA). The law is clear, if an item that was previously deleted for being inaccurate, outdated, or unverifiable is going to be reinserted onto the report, you must be notified within 5 days of reinsertion. The good news: this rarely happens, which means if you are aware of your rights and are equipped with the proper tools, you can work to permanently remove the item in question from your report and stop further damage to your credit report and credit score.

The Credit Movement is dedicated to sharing our knowledge of the broken credit system while helping consumers empower themselves. With the tools, tips and tricks necessary to get their credit scores into the best position possible. Members of this community are able to obtain home loans, car loans, lower interest rates, etc. Most importantly, you’ll sleep better at night while knowing that no problem is too big to tackle. You can get back on track faster than you think. We can help.

As Always… here’s how you get started.

Step 1:

Tap or click here to get your $1 credit report.

We’ll need it to do your credit analysis.

Note:

This is for a $1 seven day trial.

You can cancel it in the first seven days if you want, but we need this as a first step, in order to help you.

Step 2:

You will get a login and password for IdentityIQ, when you set up your $1 trial.

Go to this page on TheCreditMovement.com.

Share your username/password for IdentityIQ in the form on the page.

We are here to help you buy a home. We will introduce you to a lender once you will qualify for the loan you want.