There are hundreds of algorithms out there for calculating credit scores. This is why when you go to Credit Karma your score is, for instance, 65 points higher than what a mortgage lender pulled up for you. Credit Karma uses something called a Vantage Score which is generated oftentimes for general consumer purposes, i.e. online report providers. Mortgage companies must use approved algorithms that are determined by Fannie Mae and Freddie Mac or set mortgage lending criteria and guidelines.

The algorithms, or score calculations, being used for mortgage purposes are currently; Experian – Fair Isaac V2, Equifax –

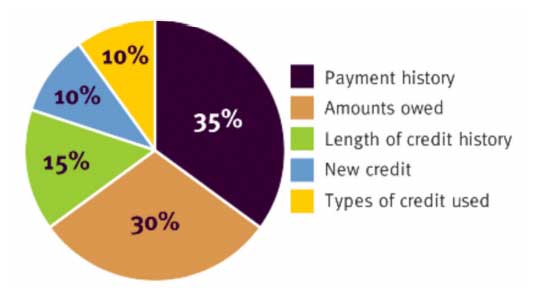

FICO Classic V5 FACTA, Transunion – FICO Classic (04). Generally speaking the credit score ranges from approximately 300 to 850. Roughly, a 550 point scale. Continue to the next section to learn each section of your score.