The Truth About Credit Inquiries

10% – New Credit (Did you open up a new account or get your credit pulled too much?). Credit inquiries and new accounts affect 10% of your overall credit score. It is imperative that you understand the impact that applying for and opening new credit could have on your credit score. Especially if your short-term goal is to purchase a home. Opening up a new account could affect your credit score by 15 points or more. The algorithm used to calculate your credit score will penalize consumers for opening new credit. A method of deterring over-extending ones self.

Shopping for a vehicle can be one of the most detrimental things you can do to your credit score. Car dealerships often tell you, “we are going to find you the best interest rate and lowest payment”. What I have come to learn is that what they actually are doing is trying to find the highest kickback. We also call Cars dealerships as Bank fees. This is why the dealership will pull your credit 5, 10, or even 15 times or more — they are searching for who is going to pay them the most to give them the deal.

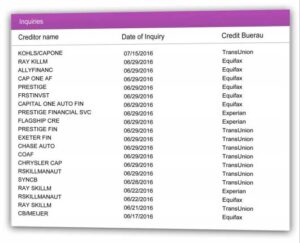

Inquiries

See the below image showing 18 inquiries over the course of 2 weekends of car shopping. This could hurt your credit score anywhere from 30 to 60 points!

You could also request that the dealership only pulls your credit through one of their affiliate banks. Understanding the way car inquiries could damage your credit is important. You should also understand that there is a myth out there that consumers have a “30-day shopping window” and if your credit is being pulled for the same purpose (i.e. auto loan, home loan, credit card) that it only counts as one inquiry. This is only true if the inquiries are coded the same way and pulled through the same provider. Auto finance companies will code inquiries as “consumer”, “auto loan”, “auto lease”, etc. Each of these types would hurt your score 3-5 points for the first 6 months with a diminishing impact.

Inquiries remain on your report for up to 2 years.

There are 3 types of inquiries: hard, soft, and promotional. The hard inquiries are of the utmost importance as these are the ones that, as just mentioned, ding your score 3-5 points for the first 6 months with a diminishing impact over the 2 year period they remain. Hard inquiries happen anytime you apply for something — a home loan, an auto loan, a credit card, etc. Pulling your own credit as a consumer does not negatively impact your score. These are considered soft inquiries. Another form of a soft inquiry is known as an “Account Review Inquiry”.

Typically these are done by credit card companies to reassess risk. For instance, if your score goes down 40 points, the credit card company reserves the right to increase your interest. Another travesty of the credit scoring system is that during one of these routine credit checks if your score happens to go up, they will not lower your interest rate.

Page 17Chapter-1 –

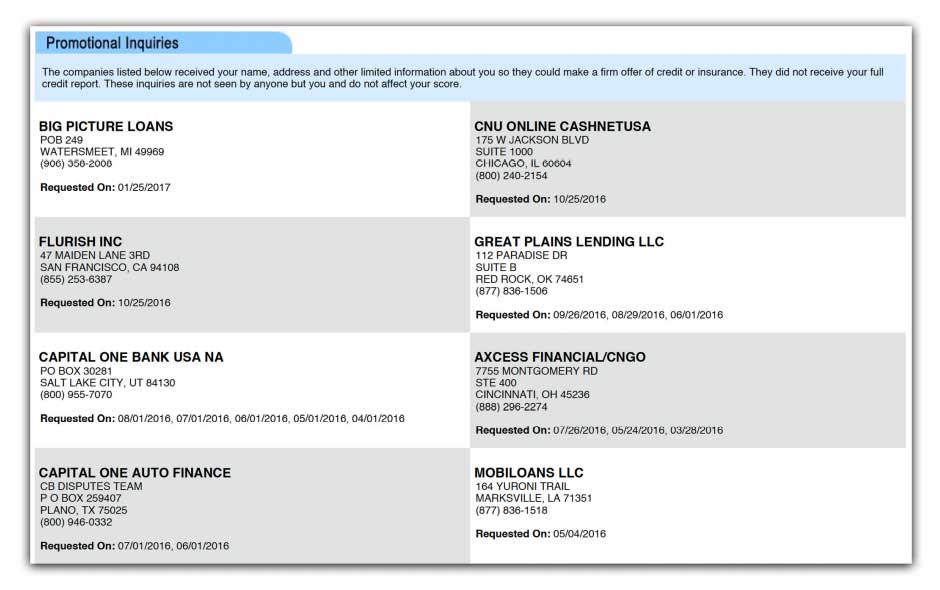

Truth About Inquiries… Promotional inquiries are a form of acquiring data for direct mail or other forms of marketing credit cards or services to a consumer.

The credit bureaus, Experian, Equifax, and Transunion are not private companies but rather for-profit, publicly traded entities. They have a duty to make money for their shareholders. One of the ways they do that is by selling consumer data to anyone willing to purchase it. An example would be Capital One wanting to market a credit card to consumers via a direct-mail campaign of “pre-approval” letters.

They contact Equifax and say we will give $150,000 for a list of 1 million consumers with credit scores ranging from say, 620-660. They target a specific group of consumers that their research indicates pay their bills on time. But is somewhat irresponsible with their credit decisions. This is exactly what credit card companies want. An individual who has a high probability, according to their research, of getting approved for a $2000 limit credit card, and then proceeds to max it out and then make minimum payments for the rest of their life at 19% interest or even more. Jackpot for the credit card company.